osceola county property tax due date

Remember to have your propertys Tax ID Number or Parcel Number available when you call. The average yearly property tax paid by osceola county residents amounts to about 348 of their yearly income.

Osceola County Tax Collector S Office Bruce Vickers Servicios Facebook

Learn how Osceola County levies its real property taxes with our detailed review.

. The due date is on the 20th day of the month. Issued Dec 2022 Due by Feb 14 2023. The following discounts are applied for early payment.

Search all services we offer. Failure to file your TPP Return by the deadline is subject to penalty per Florida Statute 193072. After 500pm After this time all unpaid taxes will be sent as delinquent to the Livingston County Treasurer.

March 1 2023 2022 unpaid taxes go delinquent. If the owner fails to pay hisher taxes a tax certificate will be sold by the Tax Collector. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email.

Gross amount paid in March no discount applied. Current Tax Due Dates Summer Tax. If you have sold this property please forward this notice to the.

What is the due date for paying property taxes in Osceola county. 2 discount if paid in January. This deferment allows you time to pay your winter taxes between March 1 - April 30 without penalty or interest in anticipation of receiving a homestead property tax refund.

Application If you qualify please fill out an Application for Deferment of Winter Taxes pdf and return the application and a copy of your MI-1040 CR to the following address before April 30th. Process of unpaid taxes. 2021 OSCEOLA COUNTY PROPERTY TAX 1.

March 31 Full amount due on Real Estate and Tangible Personal Property Taxes. 1300 9th street suite 101b. ¼ of the total estimated taxes discounted 6.

Find us at one the following locations. Learn all about Osceola County real estate tax. Deadline to File for Exemptions.

Tangible Personal Property Returns Due. If you have documents to send you can fax them to the Osceola County assessors office at 407-742-4900. April 30 2020 Installment Plan Applications Deadline.

If you are considering becoming a resident or only. File Tourist Tax Return and Pay Taxes. Issued July 2022 Due by Sept 14 2022 Winter Tax.

Welcome to the tax online payment service. Sub-tax payments will be accepted starting mid-September. New applicants must report monthly for the first year.

OWNERSHIP Are you still the current owner of the property. Osceola County Courthouse 300 7th Street Sibley Iowa 51249 712 754-2241. Payment due by June 30 th.

Osceola County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. Payment due by September 30 th. The deadline for submission of your 2021 Tangible Personal Property Tax Return is April 1 2022.

Real estate taxes become delinquent each year on April 1st. The plan requires that the first installment must be made no later than June 30th to receive a discount. Economic Development Commission 300 7th Street Sibley Iowa 51249 712 754-2523.

Whether you are already a resident or just considering moving to Osceola County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The tax return form is here. Property owners are required to pay property taxes on an annual basis to the County Tax Collector.

Your list must be in permanent number order. 4 discount if paid in November. Payments accepted after June 30th but before July 30th are not discounted.

Osceola County collects on average 095 of a propertys assessed fair market value as property tax. You can call the Osceola County Tax Assessors Office for assistance at 407-742-5000. ¼ of total estimated taxes plus ½ of any adjustment for actual tax liability discounted 3.

Ultimate Osceola County Real Property Tax Guide for 2022. These taxes are due Monday February 28 2022 by 500pm. Assessment Valuation End Date.

Contact the Treasurers Office for exact dates. Make check payable to. ¼ of the total estimated taxes discounted 45.

Valorem taxes for the fiscal year October 1 2021 through September 30 2022. You can either report at a monthly or quarterly frequency. Winter taxes are due by February 14 without penalty.

If you dont pay by the due date you will be charged a penalty and interest. Please take a minute to carefully examine the information on the enclosed tax notice and verify the following information. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Run a Business Tax report Run a Real Estate report Get bills by email Cart.

Property taxes are due on September 1. Payment due by December 31 st. Osceola County has one of the highest median property taxes in the United States and is ranked 516th of the 3143 counties in order of median property taxes.

If you have any further questions please call us at 217 384-3743 or email us at treasurercochampaignilus. 1 discount if paid in February. All taxes become delinquent to the County Treasurer on March 1 with additional penalties and interest.

If you dont pay by the due date you will be charged a penalty and interest. Summer taxes are due by September 14 without interest. The median property tax also known as real estate tax in Osceola County is 188700 per year based on a median home value of 19920000 and a median effective property tax rate of 095 of property value.

Know the tourist development tax due dates to avoid penalities. Failure to make the first payment will automatically cancel the participant from the plan and the taxpayer will be required to pay the taxes due in full by March 31st. June 1 2020 First Installment Payment Due.

The gross amount is due by March 31st of the following year. March 1 2024 2022 unpaid taxes go into forfeiture. If you would like to pay when we are closed or prefer not to come inside we have a walk-up secured drop box that is located to the right of the main entrance doors on the front side of our building.

The median property tax in Osceola County Florida is 1887 per year for a home worth the median value of 199200. March 31 Fourth 4th and final Installment Payment Due on 2019 Taxes. Taxes become delinquent on April 1st of each year.

3 discount if paid in December. Please call the assessors office in Kissimmee before you send.

2018 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

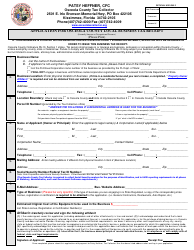

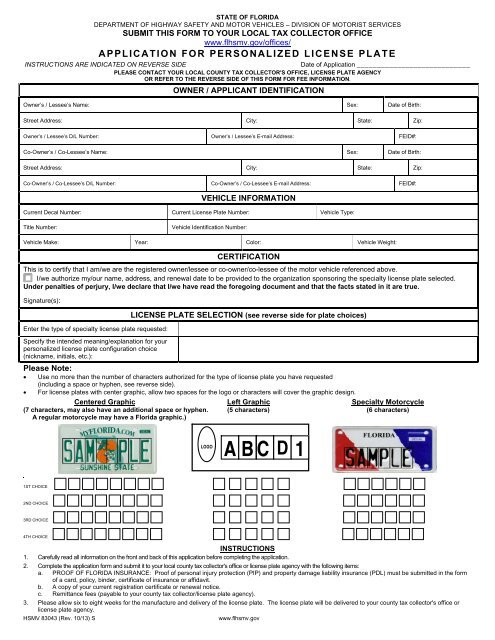

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Ayment Ptions Osceola County Tax Collector

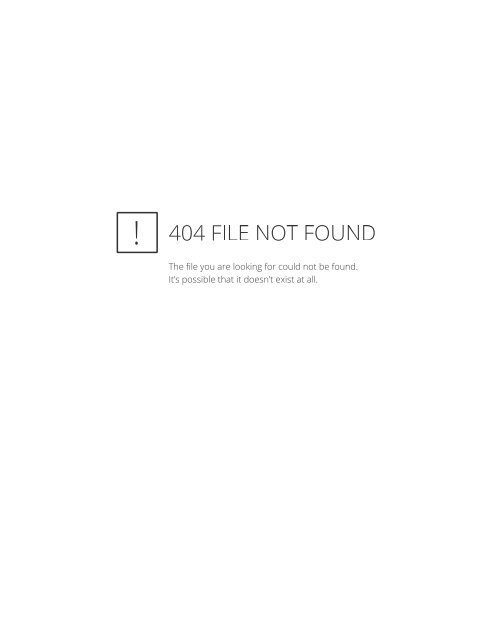

Application For Personalized License Plate Osceola County Tax

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Osceola County Tax Collector S Office Bruce Vickers Facebook

Osceola County Tax Collector S Office Bruce Vickers Facebook

Osceola County Florida Application For Osceola County Local Business Tax Receipt Form Download Fillable Pdf Templateroller

Osceola County Property Appraiser Katrina S Scarborough Cfa Ccf Mcf

Distrito Escolar Del Osceola County School District

Osceola County Frequently Asked Questions Indian Wells Hoa

Osceola County Site Development Plan Pdf Document Library

Ayment Ptions Osceola County Tax Collector

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc